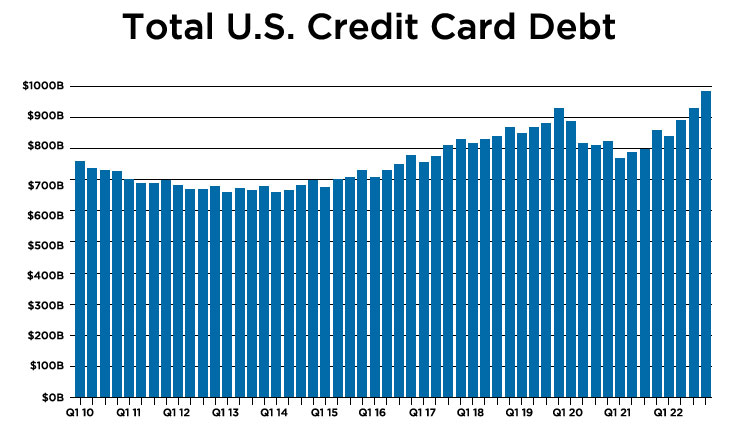

Credit card debt in the United States hit a record high at the end of 2022, topping out at almost $1 trillion for the first time ever. During the last quarter of the year, delinquencies were growing at a faster and faster rate. The Federal Reserve Bank of New York released data that showed overall balances growing by $61 billion over the last three months of 2022 – with a grand total of $986 billion for Q4. This was the largest increase over a single quarter since the bank started tracking changes in 1999.

During COVID, it seemed like the only thing financial experts were talking about was the increases in US consumer debt, with countless pieces written about the growing number of people missing monthly payments. During the last quarter of 2022, more Americans missed payments and became more than 90 days behind than before the pandemic caused a drastic shift in Americans’ finances. This could spell huge trouble when the student loan pause is lifted later in 2023.

Wilbert van der Klaauw, an economic research advisor at the New York Federal Reserve, said that “although historically low unemployment has kept consumers’ financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers’ ability to repay their debts.”

Between the fourth quarters of 2021 and 2022, US credit card debt grew by over $130 billion – that’s the highest annual gain on record, and it is an even bleaker picture when you pair that debt with incredibly high interest rates.

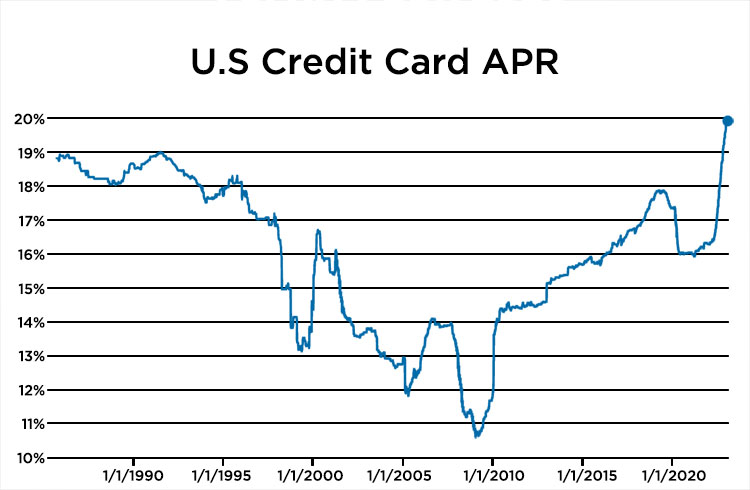

According to Bankrate, the average APR on credit cards in the United States is nearly 20%. That’s the highest interest rate we have seen in 37 years. Typically, credit card interest rates move up or down at the same rate as the federal interest rate. Since the Federal Reserve has aggressively increased the interest rate to (potentially) fight off inflation and a recession, credit card interest rates have skyrocketed as well.

When the new York Fed released the report, an informational blog post from the researchers said Americans have been facing higher prices everywhere and “it is possible that increasing prices – and correspondingly, debt service payments – are cutting into borrowers’ balance sheets and making it more difficult for them to make ends meet.”

The report also showed that more auto loan borrowers are missing monthly payments – especially among younger borrowers. Since automotive loans typically have fixed interest rates, the increase in federal interest rates are not to blame here. However, since many dealers charged higher prices during the pandemic-fueled inventory shortage, that has resulted in higher car payments for many Americans.

The researchers suggested that it is possible that the increase in delinquencies for both credit cards and auto loans could be a simple “reversion to pre-pandemic” levels now that the high levels of government pandemic support have ended.

The student loan payment pause is ending in June, and the researchers are concerned that younger borrowers will struggle to make payments once they are required to resume payments If those payments start to back up – or if the Supreme Court overturns President Biden’s loan forgiveness – the financial picture could become much worse. “It’s definitely troubling to think what’s going to happen to delinquency rates once everybody has to start making student loan payments again,” said Matt Schulz, chief credit analyst for LendingTree.

So what does this all mean? All indicators point toward a sharp increase in bankruptcy cases in the US this year. We have already seen the average number of cases in the Dallas area rising to much higher levels than 2022. If you are struggling with credit card debt and cannot seem to catch up, call Rubin & Associates today at 214-760-7777 and set up a free consultation. Our experienced team of attorneys specializes in bankruptcy – we do not work on any other types of cases, and we’re dedicated to helping you get the fresh start you deserve.