Can you file for bankruptcy during a divorce?

One of the most common questions about bankruptcy is, “Can you file for bankruptcy during a divorce?” The short answer is yes, but there are several considerations to take into account before moving forward with both legal processes simultaneously. Understanding the potential advantages and complications can help you determine the best course of action for your financial future.

Bankruptcy and divorce: two separate legal processes

Bankruptcy and divorce are both complex legal matters, and while they may overlap in certain areas, they remain distinct processes. Bankruptcy is a federal legal procedure designed to help individuals eliminate or restructure debt, while divorce is a state-level legal process that involves the division of assets, liabilities, and determining responsibilities such as spousal or child support. (more…)

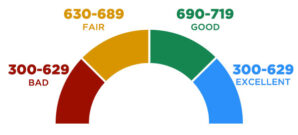

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there? One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed.

One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed. Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year.

Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year.