How do you know if you need to file for bankruptcy?

Financial stress can be overwhelming, especially when debts start to mount and you feel like you’re struggling just to stay afloat. Many people wonder if bankruptcy might be the solution, but deciding whether or not to file for bankruptcy can be complex. It is a big decision with lasting effects, and understanding when it might be appropriate to consider bankruptcy is essential. You should always talk with an experience bankruptcy attorney – they’ll help you understand your financial picture and assist you in choosing the right path forward. you should also watch for these common signs:

You are struggling to make minimum payments on debts

One of the first indicators that bankruptcy might be worth considering is when you are unable to make the minimum payments on your credit cards, loans, or other debts. Minimum payments are usually designed to keep you in good standing with creditors, but if even these are a challenge, it could mean your debt has grown unmanageable. While this situation does not automatically mean bankruptcy is the answer, it’s often a red flag that financial assistance may be needed. (more…)

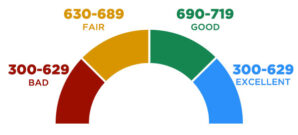

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there? One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed.

One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed. Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year.

Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year. So – all those awful things you’ve always heard about bankruptcy… Did you know that almost all of it is completely untrue? Some of it is rumor, some of it is urban myth, and a lot of the stories are perpetuate by creditors who want you to be scared of bankruptcy.

So – all those awful things you’ve always heard about bankruptcy… Did you know that almost all of it is completely untrue? Some of it is rumor, some of it is urban myth, and a lot of the stories are perpetuate by creditors who want you to be scared of bankruptcy.