Only half of Americans think they can pay off their December credit card bill

Only 51% of Americans in a recent survey were confident that they could pay off their credit card bills this month – a big increase from the same time period last year. Every month, LendingTree conducts its Credit Card Confidence Index, and the December 2023 results are the worst since the survey began in September of 2018.

Only 51% of Americans in a recent survey were confident that they could pay off their credit card bills this month – a big increase from the same time period last year. Every month, LendingTree conducts its Credit Card Confidence Index, and the December 2023 results are the worst since the survey began in September of 2018.

According to the report released last week, a “nationally representative” survey of American credit card holders showed that 49% did not think that they would be able to pay off their credit card bills this month. Only last month, the November survey results showed that only 42% were not confident about paying their bills. The previous low point was set in June 2022. (more…)

If you’re struggling with overwhelming debt and considering bankruptcy, the biggest question in your mind is probably “Which bankruptcy lawyer should I go to?” It’s one of the most important decisions to make – filing bankruptcy will have a significant impact on your life. Bankruptcy law is very complex, with many twists and turns, and traps for the unwary. If you need to file bankruptcy, choosing the right lawyer is critical.

If you’re struggling with overwhelming debt and considering bankruptcy, the biggest question in your mind is probably “Which bankruptcy lawyer should I go to?” It’s one of the most important decisions to make – filing bankruptcy will have a significant impact on your life. Bankruptcy law is very complex, with many twists and turns, and traps for the unwary. If you need to file bankruptcy, choosing the right lawyer is critical. Bankruptcy is more common than most people realize… In today’s world, it’s far too easy to accumulate overwhelming debt and lose control. While an unexpected bump in the road (like an automobile accident or loss of a job) can lead to a bankruptcy situation, many times, people start down the road to

Bankruptcy is more common than most people realize… In today’s world, it’s far too easy to accumulate overwhelming debt and lose control. While an unexpected bump in the road (like an automobile accident or loss of a job) can lead to a bankruptcy situation, many times, people start down the road to  Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control.

Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control.

When potential clients call us, they are usually stressed and scared. When you are drowning in uncontrollable debt, and you’re in danger of losing your car or your house, being afraid is understandable.

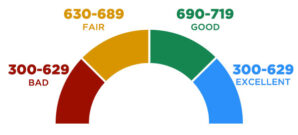

When potential clients call us, they are usually stressed and scared. When you are drowning in uncontrollable debt, and you’re in danger of losing your car or your house, being afraid is understandable. Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there? If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.

If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.