Five signs that you are living beyond your means

If you’re spending more money than you are making, you are living beyond your means. Society pushes for instant gratification and a “you only live once” mentality – but that’s not a great strategy for handling your debts.

It does not take much to start living beyond your means, and many times, it’s the beginning of a downward spiral that cannot be stopped. Once the debt starts to multiply, it is harder and harder to find your way out of the difficult situation you’ve put yourself in.

Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control.

Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control.

When potential clients call us, they are usually stressed and scared. When you are drowning in uncontrollable debt, and you’re in danger of losing your car or your house, being afraid is understandable.

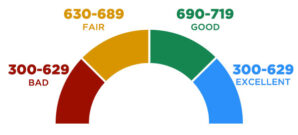

When potential clients call us, they are usually stressed and scared. When you are drowning in uncontrollable debt, and you’re in danger of losing your car or your house, being afraid is understandable. Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there? If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.

If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.

We have helped many hundreds of Dallas-area residents with their bankruptcy cases over the years, and the most common question we hear first is “Should I file bankruptcy?”

We have helped many hundreds of Dallas-area residents with their bankruptcy cases over the years, and the most common question we hear first is “Should I file bankruptcy?” The Great Recession hit America hard from December of 2007 to the middle of 2009, millions of US residents lost their livelihoods and homes. It was the worst economic downturn since the 1930s and the Great Depression, and it took almost a decade for the labor market to fully recover.

The Great Recession hit America hard from December of 2007 to the middle of 2009, millions of US residents lost their livelihoods and homes. It was the worst economic downturn since the 1930s and the Great Depression, and it took almost a decade for the labor market to fully recover.